Dividend Tax Rate 2025

Dividend Tax Rate 2025. For the 2025/25 tax year, dividend tax rates can range from 0% up to 39.35%, and your marginal rate of dividend tax is linked to your income tax band. The dividend allowance is the amount of income from dividends that an individual can earn before tax is incurred.

General mills board of directors declares dividend increase. The exact dividend tax rate you pay will depend on what kind of dividends you have.

Know the dividend income tax rate, deductions to be avail, submission of form 15g/h, tds and advance tax on dividend income.

T230017 Distribution of Individual Tax on LongTerm Capital, The exact dividend tax rate you pay will depend on what kind of dividends you have. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

T230018 Distribution of Individual Tax on LongTerm Capital, Companies that pay dividends to their shareholders in india were required to pay the dividend distribution tax (ddt). Who is likely to be affected.

T180238 Distribution of Individual Tax on LongTerm Capital, A domestic company that pays dividends to its shareholders must pay a tax on the dividend amount, called the dividend distribution tax (ddt). Understand how dividend income is taxed and stay informed about the dividend tax rates.

Dividend Tax Calculator Understanding Dividend Tax Rates, Understand how dividend income is taxed and stay informed about the dividend tax rates. The abolition of dividend distribution tax in a significant policy shift, india’s approach to dividends and the dividend distribution tax (ddt) saw substantial reforms.

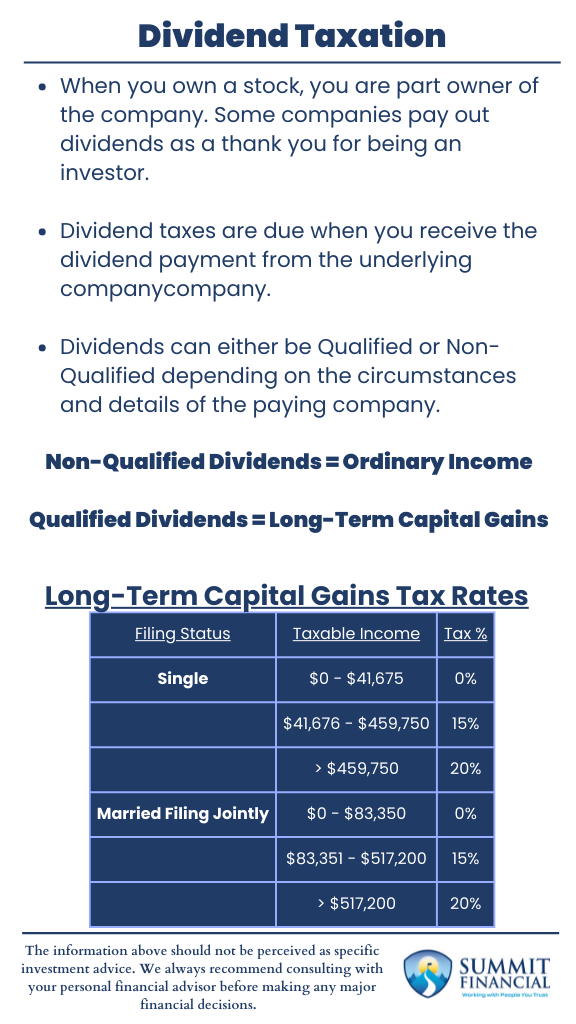

Beware! Your dividend tax rate is changing, here's what you need to know, The ddt rate is 15%. Qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status.

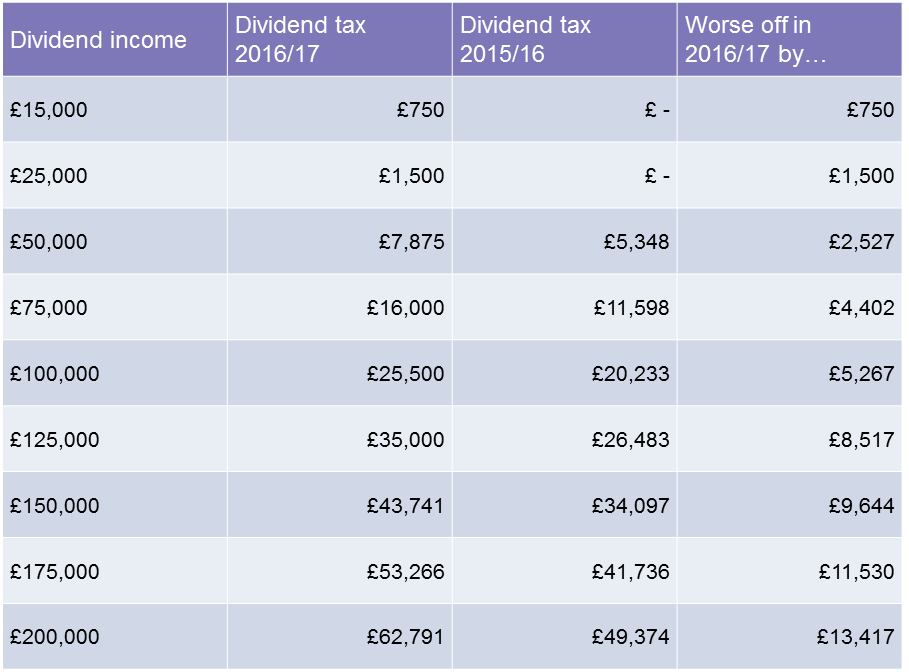

T200018 Baseline Distribution of and Federal Taxes, All Tax, For the 2025/25 tax year, dividend income beyond the £500 allowance is taxed at rates of 8.75% for basic rate taxpayers, 33.75% for higher rate taxpayers, and. The tables below are ‘ready reckoners’, showing estimates of the effects of illustrative tax changes on tax receipts.

Dividend tax rate tables A Geek From the West, The ddt rate is 15%. Above this amount, any dividends you receive from your limited.

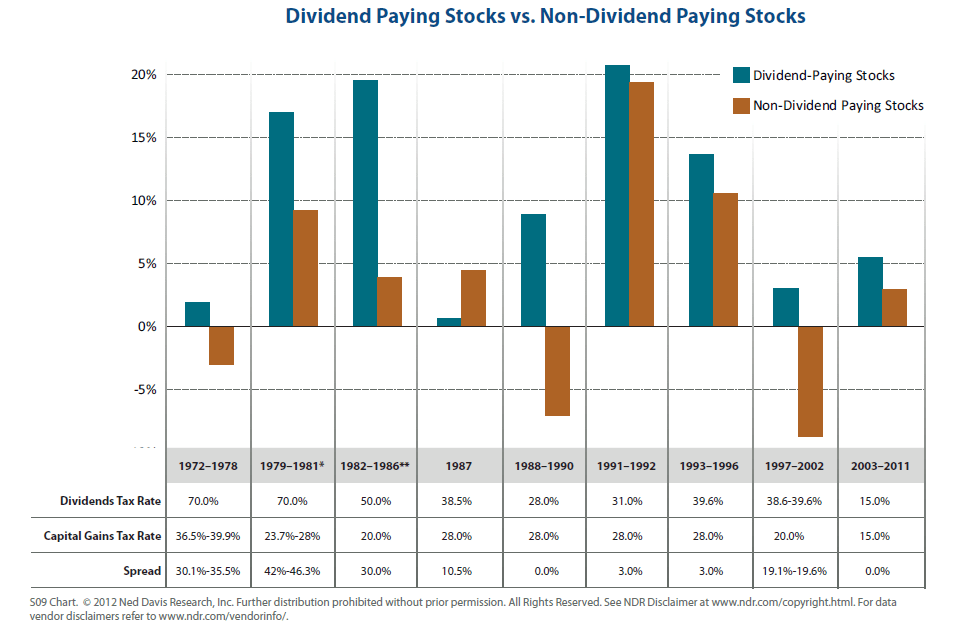

What Will be the Impact of Higher Dividend Taxes on DividendPaying, Who is likely to be affected. General mills board of directors declares dividend increase.

Understanding Dividend Taxation Summit Financial, The exact dividend tax rate you pay will depend on what kind of dividends you have. Companies that pay dividends to their shareholders in india were required to pay the dividend distribution tax (ddt).

T200055 Share of Federal Taxes All Tax Units, By Expanded Cash, No tax on £2,000 of dividends, because of the dividend allowance; Thanks to the 2025 spring budget finding the optimal blend of salary and dividends for company owners is a little more complicated than in previous years.

A domestic company that pays dividends to its shareholders must pay a tax on the dividend amount, called the dividend distribution tax (ddt).